Highlights In This Section

Are you saving enough?

Find out how much your lifestyle could cost when you retire and how to work out if your savings are on track.

Try it nowThe cost of retirement is going up

New figures show that the cost of retirement is going up so it’s important to plan ahead to ensure you have the level of income you expect at retirement.

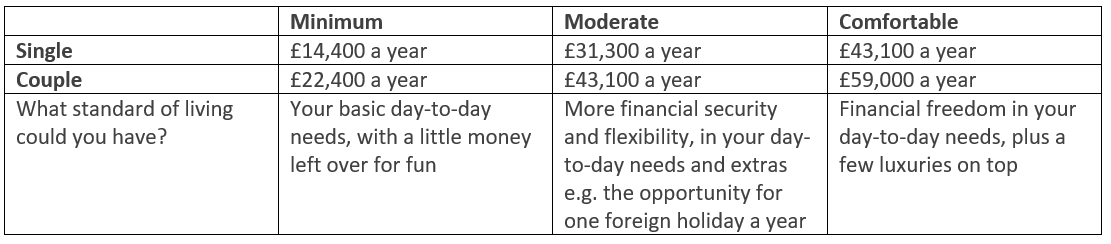

The Retirement Living Standards (RLS), created by the Pensions and Lifetime Savings Association (PLSA) and Loughborough University, estimate how much you

might need in retirement each year, based on 3 different standards of living – minimum, moderate and comfortable.

According to the latest figures, costs have increased across all 3 levels for the second year in a row, with rises of up to 34%. This means to enjoy a moderate standard of living in retirement, a single person will now need £31,300 a year, that’s

£8,000 more than suggested last year. While a couple living a moderate lifestyle will need an extra £9,100, with an annual income of £43,100.

Slightly smaller increases were suggested in the other lifestyle categories, but still represented a rise of 12% for those wanting even the minimum standard of living when they stop work.

The latest RLS figures are shown below, along with some suggestions on what you can do if you’re worried you won’t be able to afford the lifestyle you want.

Costs are higher in London and can be found in full at retirementlivingstandards.org.uk

Why have the Retirement Living Standards increased?

The RLS are reviewed regularly and updated to reflect rising prices, and the public’s expectations of what retired people will need, not just to survive, but to “live with dignity” in their life after work.

The PLSA say that rising prices of domestic fuel and energy costs are the most significant factor in increasing what is needed this year.

Other factors include the soaring prices of:

- Food and groceries

- Social and cultural participation, such as spending time with family and friends out of the home

- Motoring costs

Using the Retirement Living Standards and reaching your savings goal*

Research has shown that having something to aim for makes it more likely you will reach your goal. You could use the Retirement Living Standards as a general guide to how much you might need when you stop work, and to help you set a savings target for

your retirement.

You could also try listing all of your expenses to get a personalised idea of how much you might need.

Work out if your pension adds up

To work out whether you’re on track to afford the retirement you hope for, you’ll need to compare your likely spend with the amount of income you’re likely to get.

You can see what the income from your Amey OS pension might be by checking your Annual Benefit Statement. You can also contact your Scheme administrator, Railpen,

to request your current estimate by calling 0345 112 0025. However, you may only request two free estimates in any calendar year.

If your forecasted pension figures don’t match up to what you’re aiming for, don’t worry. There are steps you can take to improve your expected retirement income. This includes:

- Thinking about your broader financial circumstances and looking at your retirement income in the round. This includes:

- Thinking about any other pension arrangements, or other sources of income you may have. For example, you could think about when you might be able to take your State Pension. You can check your State Pension age (SPA) here.

- Thinking about whether there are things you can do now, while you’re working to reduce your outgoings.

- Thinking about when you plan to retire and whether you could consider working for longer

Get help from a financial expert or adviser

Pensions can be confusing. If you’re thinking about making changes to your pension, or taking your retirement benefits, it’s a good idea to take financial advice. You can find a list of Independent Financial Advisers (IFAs) at unbiased.co.uk.

*Figures from The Retirement Living Standards (RLS) and Lifestyle Calculator Tool are based on the income you may need after tax.

Matt Riley

Manager

Matt joined Zedra Governance Limited (formerly PTL) in January 2008 having previously worked for Mercer Limited, Hazell Carr and Prudential.

As a Manager for the company's Birmingham Office, Matt’s responsibilities include working closely with Client Directors and individually liaising with Employers, Trustees and Members to ensure the smooth running of their pension schemes. Matt’s current portfolio of clients covers ongoing, paid-up and winding-up schemes. In addition, Matt has experience of schemes that have transferred or are in the process of transferring to the Pension Protection Fund and Financial Assistance Scheme. Matt also works closely with clients in relation to risk registers and internal controls.

Matt particularly enjoys resolving issues in a fair and pragmatic way ensuring that the right result is reached for the member or employer.

Sam Burden

Client Director

Sam Burden joined Zedra Governance (formerly PTL) in 2022. He is an Accredited Professional Pension Trustee (AMAPPT) and an Associate of the Pensions Management Institute (APMI)

Sam has more than 25 years’ experience in the pensions industry gained with WTW, KPMG, and Standard Life working with a wide range of pension schemes and sponsoring employers. His trustee appointments include DB, DC and hybrid pension schemes and he has experience of handling a broad range of projects relating to the management of pension schemes.

Beyond his pensions experience Sam is a former Birmingham City Councillor where he chaired the audit committee and a current charity trustee.

Payam Kazemian

Client Director

Payam Kazemian joined Zedra Governance Limited (formerly PTL Governance Limited) in 2021. He is an Accredited Professional Pension Trustee (AMAPPT) and an Associate of the Pensions Management Institute (APMI).

Payam has more than 17 years of experience in the pensions industry. Through his current role as a professional trustee, as well as previously as a pension’s de-risking and investment structuring expert at financial institutions including Goldman Sachs and Deutsche Bank, he has had overall responsibility for creating investment, de-risking, journey planning, and governance solutions for a wide range of UK DB pension schemes. He currently holds a number of board positions (as Chair of Trustees) and sole trustee in his professional trustee capacity. Payam has been involved with a number of pensions projects including pensions buy-in, pensions buy-out, GMP equalisation, investment strategy reviews, and dialogue with the pensions regulator. Payam looks to create and believes in a collaborative relationship between the sponsor, the trustee, and all other parties involved as this results in best member outcomes and helps deliver pragmatic solutions for scheme. Aside from his pensions experience, Payam holds a Ph.D. in Materials Science from the University of Cambridge.